THIS WEEK IN LOGISTICS

What we’re covering…

- How industrial real-estate executives expect limited fallout from the turmoil engulfing the US banking sector ?

- This week’s featured news stories, including the increase in the number of older ships being sold for further trading in 2022 ?

- The ‘Hurry up and get it done,’ culture at Norfolk Southern, and the push for railroads to examine their policies after accidents ?

- Logixboard’s featured content and an exclusive sales resource ?

IN THE NEWS

Warehouses Insulated From US Banking Crisis As Space Remains Tight

As COVID-19 shook the world, one of the industries to see extensive growth was e-commerce and trade. Thanks to lockdowns and restrictions, people chose to spend on various goods from the comfort of their homes. As demand increased across 2020-21, the industry felt the need to expand storage space to cater to consumer needs.

As a result, warehousing capacity was a major area that supply chains and logistics companies, as well as retail, manufacturing, and e-commerce players heavily invested in. But come 2022-23, as demand declined due to inflationary pressures, and spending shifted once again from goods to services, there were concerns that investments in warehousing may be a liability. Now as the US banking sector takes a hit, these concerns have increased.

TOP HITS THIS MONTH

Featured blog posts

LOGIXBOARD INSIDER

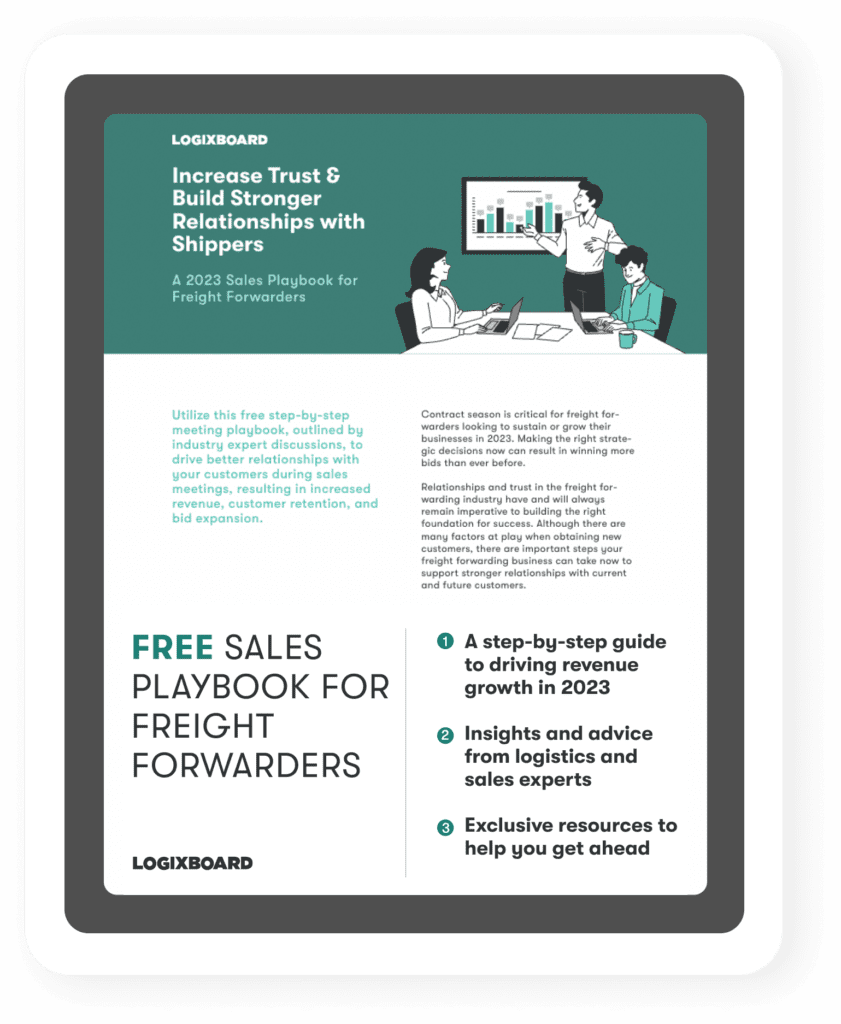

Are you ready to invest in stronger customer relationships in 2023? Check out this Sales Playbook for Forwarders ?

This free resource features step-by-step instructions and advice from industry experts to help you drive customer acquisition and generate more bids this year ?

Download the guide to see it for yourself ?

- The number of older ships sold for further trading continued to swell in 2022, according to a report by the BRS Group. The broker attributed the jump in sales to the “king’s choice” afforded to tanker owners last year, where healthy rates and rising asset values meant an owner was making money regardless of what he or she decided to do with their fleet.

- AirBridgeCargo Airlines is set to relaunch on 3 June, using two Russian Ilyushin IL-96 freighters. AirBridgeCargo’s existing fleet of 747s and a 777 are stored in Russia, as legal arguments continue with western lessors. ABC’s sister carrier, Volga-Dnepr Airlines, has continued to operate since Russia invaded Ukraine, although it can no longer fly to Europe or North America.

- The price of ship fuel is now down to around half (46% drop in costs) of the post-Ukraine-invasion peak. Second-quarter fuel surcharges for containerized cargo shippers promise more savings ahead. If shipping ultimately switches from fuel oil to LNG or methanol as part of its much-ballyhooed energy transition, future fuel costs will likely skyrocket back to levels seen after the invasion.

- Supply shortages threaten US infrastructure and war efforts. The supply chain woes that sent costs soaring and spurred shortages of everything from toilet paper to passenger cars are easing for retail-focused industries, but remain stubbornly persistent in important growth sectors like autos, machinery, defense, and non-residential construction, experts said.

ON OUR RADAR

Federal Regulators Push Norfolk Southern To Examine Their Policies Following Railroad Accidents

Norfolk Southern has been in the news for all the wrong reasons, as multiple accidents have occurred due to the railroad assets crashing. As a result, various regulatory bodies have been looking into the company’s safety culture, hoping to find out the reason for these mishaps, so that they can be mitigated in the future. In fact, Norfolk Southern’s practices are a prime focus of federal regulators after a spate of major accidents since December 2021, three of which resulted in fatalities. Its derailment in East Palestine, Ohio, on Feb. 3, which released toxic chemicals, has spurred lawsuits from residents, business owners, and the state alleging negligence.

The National Transportation Safety Board, which typically investigates major transportation and hazardous-materials accidents, opened a special probe into Norfolk Southern’s safety culture, a move it hadn’t made in years. The Federal Railroad Administration separately has opened a safety probe into Norfolk Southern.

At the center of Norfolk Southern’s practices— and those of most other big railroads today— is a management system called precision-scheduled railroading, or PSR, designed to improve service, make operations more efficient, and cut costs. The industry impact since large US freight railroads started adopting PSR about six years ago has been similar to that of lean manufacturing on factories decades earlier. The changes helped Norfolk Southern squeeze more revenue out of each ton of freight it moved.

While statistics don’t show a clear link between the implementation of PSR and changes in accident rates, the system introduced new hazards and additional risks. Derailments, the most common kind of accident, have fallen by more than half at major freight railroads since 2000, federal data show. Norfolk Southern, which adopted the PSR system in 2019, reported fewer derailments in 2022 than in any other year in the past decade. But their overall accident rate— counting collisions and other types of mishaps in addition to derailments— climbed 25% from 2019 to 2022.

Norfolk Southern isn’t an outlier in the safety issues it is facing. Other large freight railroads have also dealt with service disruptions after overhauling operations to adopt precision scheduling. Some problems stem from rail-yard congestion as employees handle longer trains and workers sometimes must do work they have little training for, all under tighter time pressure. Essentially, in a bid to improve operations, have more cars on the road, and increase revenues, Norfolk Southern and other railroads seem to be facing new problems, and need to find a way to deal with these, by perhaps taking a deep look at their people culture and policies.