THIS WEEK IN LOGISTICS

What we’re covering…

- How logistics companies are paring back their expectations for a demand surge as retailers keep new orders in check ?

- This week’s featured news stories, including hundreds of Walmart workers being asked to find jobs within 90 days ?

- Trending: Is inflation crushing e-commerce volume growth? ?

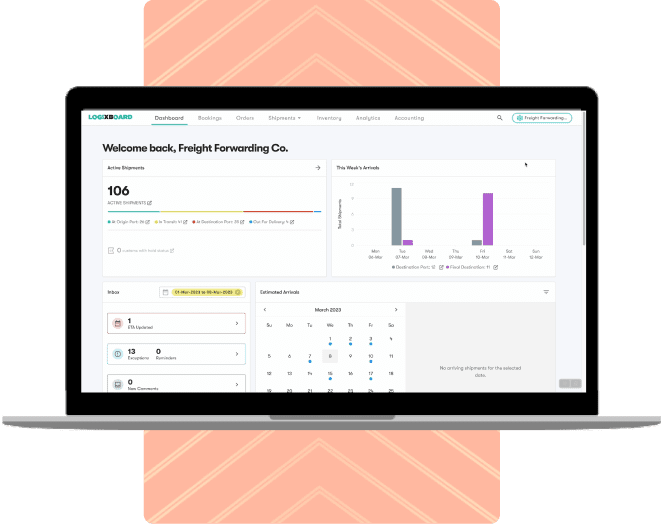

- Logixboard’s featured content and upcoming webinar ?

IN THE NEWS

Logistics Companies Hold Back Demand Surge Expectations As Retailers Reduce New Orders

Thanks to the COVID-19 pandemic, the industry experienced a surge in demand across 2020-2021, as people dealt with lockdowns and restrictions. Supply chains meanwhile faced multiple disruptions in the form of delays, port congestion, and more. Finally in 2022, due to inflationary pressure, demand dropped, and the supply chains were able to regain a sense of order.

Now in 2023 though, falling demand has become a concern for logistics players. In fact, freight companies are dialing back expectations that demand will recover strongly in the second half of the year amid growing economic uncertainty and signs retailers are growing more guarded about placing big orders in 2023.

TOP HITS THIS MONTH

Featured blog posts

LOGIXBOARD INSIDER

Our LXB U: Open House ? is only two days away ⏰

Join us to walk through live demos of our latest and upcoming product updates, from shipment visibility enhancements to CargoWise WriteBacks ?

Airing next Thursday, March 30th, at 10am and 4pm PDT ?

- Hundreds of workers at five US Walmart facilities are being asked to find jobs within 90 days at other company locations. About 200 workers at Pedricktown, New Jersey, and hundreds of others at Fort Worth, Texas; Chino, California; Davenport, Florida; and Bethlehem, Pennsylvania were let go.

- The International Federation of Robotics reports a first with one million robots in the automotive industry. According to the federation, automotive accounts for one-third of all robots installed across all industries

- Retailers are gaining huge savings on ocean container transport as once sky-high shipping prices tumble toward pre-pandemic levels and companies delay signing annual contracts so they can bargain rates down even further.

- The Port of Virginia is on schedule to complete a major rail expansion project at Norfolk International Terminals (NIT). Expected to be completed in 2024, the $83 million project is designed to boost the port’s capacity to handle rail cargo by more than 35%, port officials said in a press release.

ON OUR RADAR

Is Inflation Crushing E-Commerce Volume Growth?

As the COVID-19 pandemic threatened the world in 2020-21, e-commerce demand grew exponentially. This was partly because of lockdowns and restrictions, as consumers were not able to step out. In turn, demand for goods via shipping and delivery increased.

Another possible factor contributing to the increase in demand is the rise in disposable income among consumers. With limited opportunities for spending on services due to the pandemic, online ordering has become a popular alternative, further driving up demand. But in the second half of 2022, and now in 2023, as the world resets to a form of normalcy, consumers have shifted spending on services again, while spending on goods has decreased. Meanwhile, there are concerns about inflation adding to reduced e-commerce volume growth as well.

Walmart announced layoffs affecting approximately 200 employees in its Bethlehem, Pennsylvania, fulfillment center. Amazon CEO Andy Jassy announced that the e-commerce giant would cut 9,000 jobs, the latest in a string of layoffs.

Something’s happening in e-commerce, but it’s difficult to disentangle all of the data: Census Bureau numbers on seasonally unadjusted e-commerce retail sales were up 6% year over year (y/y), but they’re only current as of the fourth quarter of 2022. There’s some evidence that e-commerce volume growth is slowing significantly. UPS was already seeing a drop in domestic parcel volume in the fourth quarter of 2022 — business-to-consumer volumes were down 3% y/y and business-to-business volumes were down 5.2% y/y.

Meanwhile, demand for cardboard boxes is plunging, seemingly confirming that American consumers are making fewer online purchases and parcel integrators are handling fewer packages. During the question-and-answer portion of Walmart’s earnings call in February for the fourth quarter of the fiscal year 2023, CEO Doug McMillon made a telling comment highlighting the trend across the last 12 months, where there was a business shift and people started favoring food and consumables over general merchandise by over 300 basis points. This trend is only expected to continue and get a little bit worse.

So there’s a complex set of shifts in consumer behavior: people choosing food and essentials over durable goods, higher income customers shopping more at budget grocery stores, and grocery customers in general buying more private label than name-brand foods. Each of those three trends, it seems, is being driven by inflationary pressures on consumer wallets. Their dollars just aren’t going as far, so they’re making thriftier choices.

What does this mean for transportation providers, consumer brands, and retailers? Softer e-commerce growth might actually be good for some transportation companies, but it remains to be seen how inflationary pressure will actually affect demand in the rest of 2023.