In this article

THIS WEEK IN LOGISTICS

What we’re covering…

- Warehousing employment falling to the lowest level in more than a year ?

- This week’s featured news stories, including MSC making $36 Bn on the container side EBIT last year ?

- Predictions that the excess supply and associated costs of storage will persist this year ?

- Logixboard’s featured content and our recent webinar ?

IN THE NEWS

Warehousing Employment Falls To Lowest Levels In A Year As Companies Cut Jobs

As COVID-19 hit the world in 2020 and through 2021, lockdowns and restrictions became the norm. As a consequence, consumers started buying online, with e-commerce activity increasing exponentially. Demand for goods also increased at this time, leading to supply chains and manufacturing or retail companies bulking up their operations. Dollars were poured into warehousing to increase storage space as well. But in the second half of 2022 and now in 2023, demand has dropped. Thanks to inflationary pressure, various industries are experiencing job cuts and layoffs. Warehousing employment too fell to the lowest level in more than a year as companies slashed payrolls amid a downturn in the goods-moving economy.

The latest preliminary jobs report from the Labor Department reveals that U.S. employers have cut 11,800 jobs in the warehouse and storage sector between February and March. As a result, employment dropped to 1.91 million jobs in March 2023, the lowest number in the sector since January 2022, when companies employed 1.88 million workers.

TOP HITS THIS MONTH

Featured blog posts

LOGIXBOARD INSIDER

Couldn’t make it to our LXB U: Open House? Watch the recording ?

See what’s new at Logixboard from the past month, including:

- Streamlined Shipment Filters ?

- TEUs Visibility in Analytics ?

- ACT WriteBack to CargoWise ✏️

- … and more

- The founder of Mediterranean Shipping Co (MSC), a cruise giant as well as the world’s largest container line, Aponte saw his net worth grow by $14.4bn in the 12-month period through to March 10, according to Forbes. The shipping liner, MSC, made $36 Bn on the container side EBIT last year.

- The top occupier of “big-box” warehouse leasing activity in North America during 2022 was third-party logistics providers (3PLs), who unseated the retailers and wholesalers category for the top spot, according to industrial real estate firm CBRE.

- Positive ocean freight sentiment keeps the charter market bullish. According to a recent survey of supply chain professionals by logistics platform Container xChange, 48% of respondents believe this year’s peak season will be better than last year’s.

- The port of entry in Laredo, Texas, regained the No. 1 spot among 450 international US gateways for trade in February. Laredo recorded $24.6 billion in two-way trade, with Mexico’s commerce accounting for $23.9 billion, according to the latest US Census Bureau data analyzed by WorldCity.

ON OUR RADAR

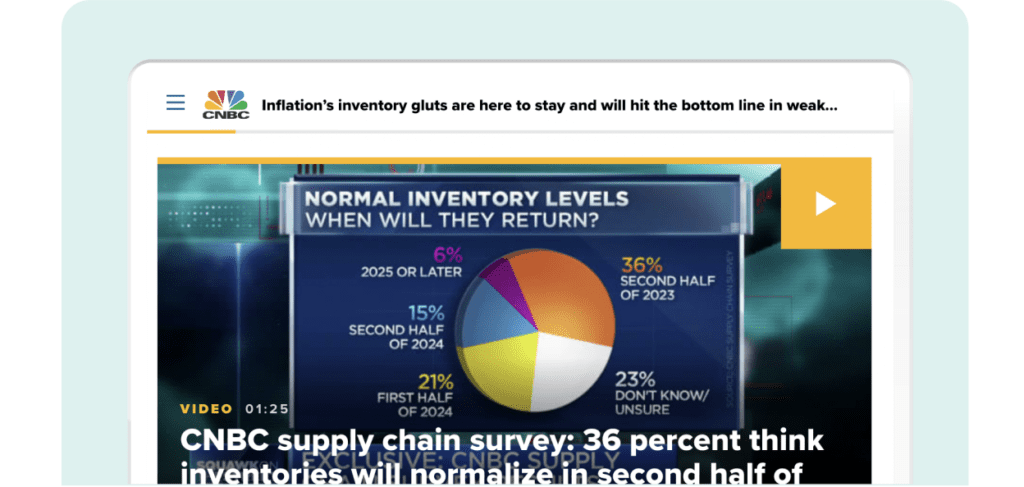

CNBC Supply Chain Survey Predicts Bloated Warehouse Inventories Will Persist

COVID-19 saw demand increase, leading to retailers and manufacturers as well as supply chains beefing up their operations throughout 2020-21. But starting in Q4 of 2022, inflationary pressure has had an impact on demand. Consumers are also shifting to services instead of goods as the world opens up after the pandemic. As a result, supply chain and logistics companies, as well as retailers and manufacturers are having to shell out big to store excess inventory and dispose of it. In fact, bloated warehouse inventories are an expensive pressure eating away at the bottom line of many companies. The excess supply and associated costs of storage won’t abate this year, according to a new CNBC Supply Chain Survey.

A total of 90 logistics managers representing the American Apparel and Footwear Association, ITS Logistics, WarehouseQuote, and the Council of Supply Chain Management Professionals, or CSCMP, participated in the survey between March 3-21 to provide information on their current inventories and the biggest inflationary pressures they are facing and often passing on to the consumer.

According to the new CNBC Supply Chain Survey, a little over one-quarter (27% of the surveyed) say companies are selling excess inventory on the secondary market because high storage prices are hitting the bottom line, with impacts to materialize in upcoming quarterly results. As expectations rise that Wall Street will revise earnings estimates lower in a weaker economy, almost half of those surveyed said the biggest inflationary pressures they are paying are warehouse costs, followed by rent and labor, and many are continuing to pass those costs on to consumers.

Just over one-third of managers surveyed (36%) said they expect inventories to return to normal in the second half of this year, with an equal percentage expecting the glut to last into 2024. Meanwhile, 21% of managers surveyed said a return to normal can occur in the first half of 2024, and another 15% expected normal activity by the first half of 2024. But uncertainty about inventory management is significant, with almost one-quarter (23%) of supply chain managers saying they are not sure when the glut will be worked off. Even with orders increasing, inventory headwinds are a source of concern for logistics experts. This survey confirms that we remain in an era of serious supply chain cost-to-serve challenges.