2021 was strong on the Third-Party Logistics (3PLs) M&A front from start to finish, with 25 large M&A transactions with purchase prices over $100 million.While this year’s deal activity may have dipped, the total value of transactions in transportation and logistics continues to grow according to a midyear report from consulting firm PwC.

As we analyze the number and valuation totals of deals throughout the first half of 2022, we will consider some of the distinct factors that are reported as playing a role in the activity we have seen so far.

1. Residual Uncertainty from COVID-19

The COVID-driven, volatile 2020 3PL market created growth opportunities that resulted in heightened M&A activity in 2021. Now, in 2022, the residual effects from COVID are promoting and stifling deals.

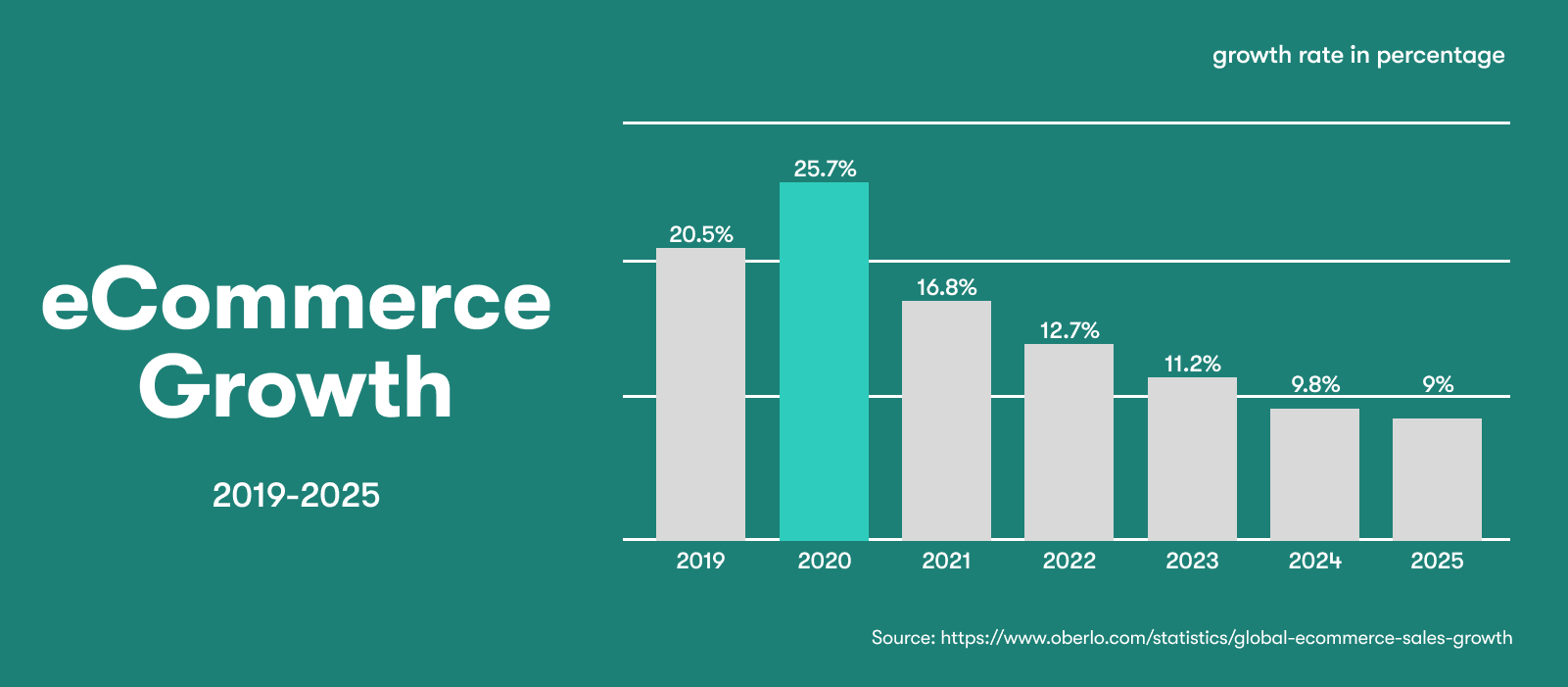

While there is still market-unease associated with emerging COVID variants, the continued reopening and recovery of the markets is impacting subsectors of the logistics industry differently. For example, while commercial transportation may be seeing some inclines, e-commerce activity has been seeing steady YOY declines since 2020 and that trend is forecasted to continue.

On one hand, the pandemic has brought on high inflation, prompting potential acquirers to scrutinize recent cost changes and evaluate how these changes impact the sustainability of EBITDA in a given deal.

On the other hand, as some 3PLs look to exit the uncertain market they are met by strategic buyers attempting to secure their supply chains and financial investors looking to capitalize on the uncertainty to strike deals that may have otherwise not been on the table.

2. Supply Chain Bottlenecks

Recent supply chain bottlenecks have reminded companies of their dependency on their logistics partners – raising the valuation of businesses like 3PLs that are able to combat uncertainties through excellent customer experience. This rediscovered reliance is also increasing the appeal of vertical integration for BCOs.

“More companies are committing capital and resources to ensure a flexible, sustainable and cost-efficient supply and delivery chain,” according to a midyear report from consulting firm PwC.

Forwarders may not be able to stop bottlenecks, but having a clear view into the supply chain and where they are at allows forwarders to provide their customers more time to make strategic decisions based on delays. Understanding this impact, BCOs are willing to pay more to work with forwarders with digital tools that provide control and visibility into their supply chain. This in turn increases the forwarders’ value to customers–and to their potential buyers.

Chasing the value of visibility and control, some businesses have begun demonstrating the desire to bring management of their supply chain in-house via acquisition. For example, in 2021 Ashley Furniture acquired a trucking fleet and American Eagle Outfitters acquired a third-party fulfillment provider and parcel-delivery.

“There’s going to be strong demand for vertical integration from suppliers, manufacturers to buy their own fleets so they have their own dedicated fleet,” said Peter Stefanovich, president at Left Lane Associates. “They want to control their own destiny.”

3. Industry Shortages

As manufacturers struggle with parts shortages and production issues, carrier equipment purchases have seen delays. To offset this, some carriers are using M&A to add hard-to-find equipment and truck drivers to their networks, whilst also bolting on complementary offerings to differentiate against competitors.

Difficulties finding drivers and equipment are pushing some fleets to M&A as well, while future problems loom for the freight forwarding and freight brokerage industry as studies are predicting a shortage in new talent coming in to fill open positions. For strategic buyers and investors, this pending shortage puts an even stronger valuation on companies who are incorporating digital automation and productivity tools into their operations now – while giving them factors to argue smaller valuations of 3PL companies not preparing to address these shortages.

The costs associated with combating the shortages in the logistics industry are making an exit attractive to some, while making adaptation and innovation the priority of others.

Invest or Exit? Either Way, it’s Time to Grow Your Business’s Value

Whether you are in a headspace to continue growing or looking to exit the industry, now is the time to focus on heightening the value of your business.

The transformation of the freight forwarding industry is being driven by elevated efficiency, productivity, and customer experience. Bringing those advancements to life within your own company needs to be a focus now if you want to acquire more customers or attract the right price while making an exit.

Logixboard knows that adding digital solutions to a business can supply the perfect tools to compete and win for freight forwarders transitioning their traditional practices to a more digitized approach to match the industry’s innovations. We’ve created an unmatched platform for customer visibility, document management, direct communication, accounting and analytics that easily integrates with leading logistics TMSs. Knowing that the time to act is now, Logixboard has also prioritized a three week average integration process for LSPs.

And it works. You can read some of our customers’ stories here.